NFT in the Marketplace

|

As the profile of NFT have risen in recent years, so too has the number of options for purchasing these digital assets. Choosing the appropriate way to buy and sell an NFT depends upon the type of NFT, and its stage in the selling cycle. Here we introduce the three main ways to increase your NFT collection. Direct Purchase from Artist or Publisher This is a common way to buy collectable NFTs, such as Bored Apes, when first put on the market. They are released in NFT "drops" where a new NFT project, or iteration of an established project, is released onto the open market in batches. These drops are generally announced in advance, and the artists and companies behind the release often spend a lot of time and energy promoting the merits of the project in NFT-related online forums such as Discord or Telegram chat groups. Drops usually take place on a first come first served basis for a fixed price, but auctions and reverse auctions are also possible. The competition for NFT with good prospects is intense, sometimes with entire drops selling out in hours, or even less, with fans and speculators hoping to significantly increase their initial outlay once the NFT is able to be sold on the open market. These secondary markets in online galleries and digital exchanges are where massive profits can be made. For example, 10000 Bored Apes were snapped upon launch in April 2021 for a few hundred US dollars, only to be flipped at prices in the seven digits within weeks. Potential secondary market riches drives much of the speculation in NFT collectables. NFT Marketplaces Much like a cryptocurrency exchange, an NFT exchange allows you to buy, sell and trade NFTs. It also makes it possible to upload and mint your digital soon-to-be asset as an NFT establishing it within a blockchain. Massive profits and media attention have led to rapid growth in the numbers of NFT marketplaces, but their fundamental processes are the same so it is easiest to understand using the example of OpenSea, the first and most established of the marketplaces. OpenSea operates in a similar way to eBay, but for the sale of NFT's. Like eBay, it is relatively easy to register for an Open Sea account and begin to resell your NFT's and purchase new NFT. Founded in January 2018, OpenSea is the first, and largest, decentralised marketplace for crypto goods, and sells digital collectables, game items, and other virtual goods secured by a blockchain. On OpenSea, anyone can buy or sell these items using a smart contract, and these exchanges are permanently stored on the Ethereum blockchain and reflected in a user's personal cryptocurrency wallet. Astronomical prices for some collectables such as Bored Apes have gained much attention, but individual artists and creators are also able to mint their own work and establish online galleries for potential buyers to peruse. Items to be minted include collectables, game items, and many other types of digital goods, and smart contracts secure all transactions. When interacting with listed items, users have the option of either entering a bid or accepting the list price, similar to eBay's Buy Now function. Auction Houses Established auction houses, most famously Sotheby's and Christie's have for hundreds of years acted as trusted sellers; and both are trying their best to keep up with the changing auction landscape. A select few established digital artists, most famously Beeple, have reached stratospheric prices, and the auction houses generating such astounding numbers have fed into the NFT hype. But the media attention has also introduced vast numbers of non-technical people to blockchain technology and expanded the market. Established auction houses have also introduced a diversity of NFT products, from tweets to software code, introduced live bidding, as well as payment in cryptocurrency, and even created virtual auction houses in online virtual worlds. |

Others

Latest News | 30 March 2022

Beyond 100: Transforming design & imagining futures with Lab4Living

Latest News | 30 March 2022

The Parametricism Era Interview with Patrik Schumacher, Principal of Zaha Hadid Artcihtects

Latest News | 30 March 2022

Purpose- Oriented Design Interview with Dr. Peter Zec, Founder and CEO of Red Dot

Latest News | 30 March 2022

ARTS TECHNOLOGY: The Future of Film-making

Latest News | 30 March 2022

Designing for a Non-Fungible World

Latest News | 30 March 2022

HKDI NFT Forum and Design Sprint 2021

Latest News | 30 March 2022

The Metaverse

Latest News | 30 March 2022

NFT Gaming

Latest News | 30 March 2022

Alternative NFTs

Latest News | 30 March 2022

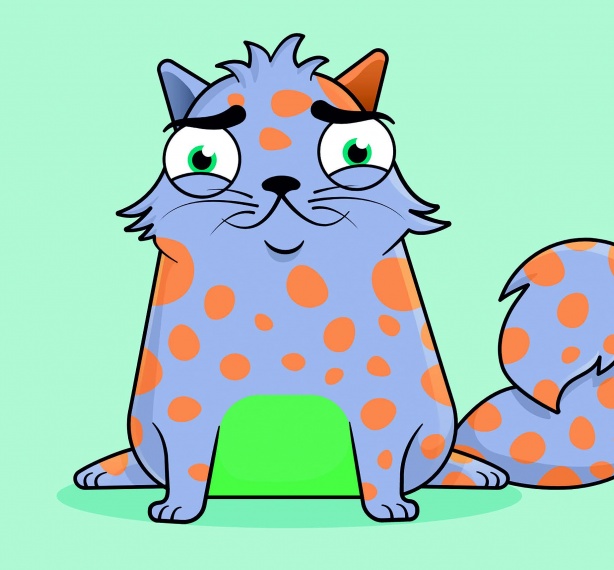

Crypto Collectibles

Latest News | 30 March 2022

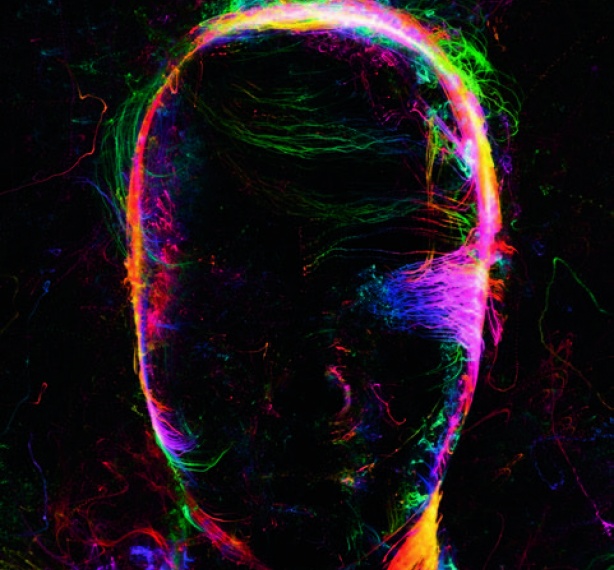

NFT ART

Latest News | 30 March 2022

What can NFT do now?

Latest News | 30 March 2022

What is NFT?

Latest News | 30 March 2022

Rethinking the Everyday: Fungible NON Fungible

Latest News | 30 March 2022

A View On Young Designers' Inspirations

Latest News | 30 March 2022

A View On Young Designers' Inspirations

Latest News | 30 March 2022

A View On Young Designers' Inspirations

Latest News | 30 March 2022

Opening of HKDI Centre for Communication Design